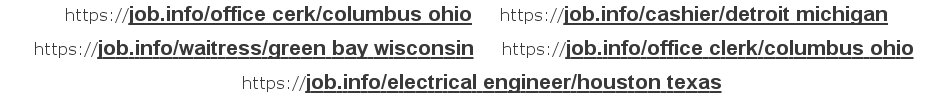

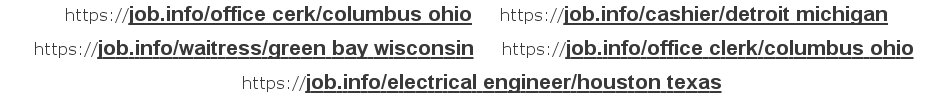

Search for your next job by using your browser's address bar. Simply enter your job search using the format shown above. Seperate, individual browser windows will open showing job search results from Indeed, Monster, Careerbuilder, and Ziprecruiter.

If seperate browser windows do not open after typing a search, you will need to disable or whitelist job.info within your pop-up blocker.

Search for jobs from any device from anywhere at anytime!

|

|